pay my past due excise tax massachusetts

The current excise tax rate for motor vehicles is 25 per 1000 of your vehicles value. In the fifth and succeeding years.

Look Up Pay Bills Town Of Arlington

Demand bills will be issued for any excise bill not paid by the due date.

. To find out if. Payment of the motor vehicle excise is due 30 days from the date the excise bill is issued not mailed. The tax collector must have received the payment.

If you are unable to find your bill try searching by bill type. Please note all online payments will have a 45 processing fee added to your total due. Nonpayment of a bill triggers a demand bill to be produced and a demand fee of.

Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Motor Vehicle Excise Tax bills are due in 30 days.

You can pay online by mail or at the Registry of Motor Vehicles. Excise tax bills are owed to the citytown where the vehicletrailer was garaged as of January 1. A person who does not receive a bill is still liable for the excise plus any demand and.

General Overview Massachusetts General Law Under Massachusetts General Law MGL 60A all residents who own a motor vehicle must pay an annual excise taxThe tax is generated by. State law allows tax exemptions for vehicles owned by certain disabled people and veterans former prisoners of war and their surviving spouses and charitable organizations. Online Payment Search Form.

Payment at this point must be made through our Deputy Collector Kelley. How do I pay past due excise tax in Massachusetts. A motor vehicle excise is due 30 days from the day its issued.

Drivers License Number Do not enter vehicle plate numbers. What if I do not receive an excise tax bill. Find your bill using your license number and date of birth.

How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. In the third year. Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor your citytown.

If you want to pay your excise tax in. For your convenience payment can be made online through their website. In the fourth year.

If the bill goes unpaid interest accrues at 12 per annum. Payment at this point must be made through our Deputy Collector Kelley. You can request a copy by calling the TreasurerCollectors Office at 781393-2550 or by e-mail at collectormedford-magov.

Not just mailed postmarked on or before the due date. THIS FEE IS NON-REFUNDABLE. Every motor vehicle owner must pay an excise tax based on valuation of at least ten percent of the.

98 Cottage Street Easthampton MA 01027 413-527-2388 413-529-0924 Fax. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

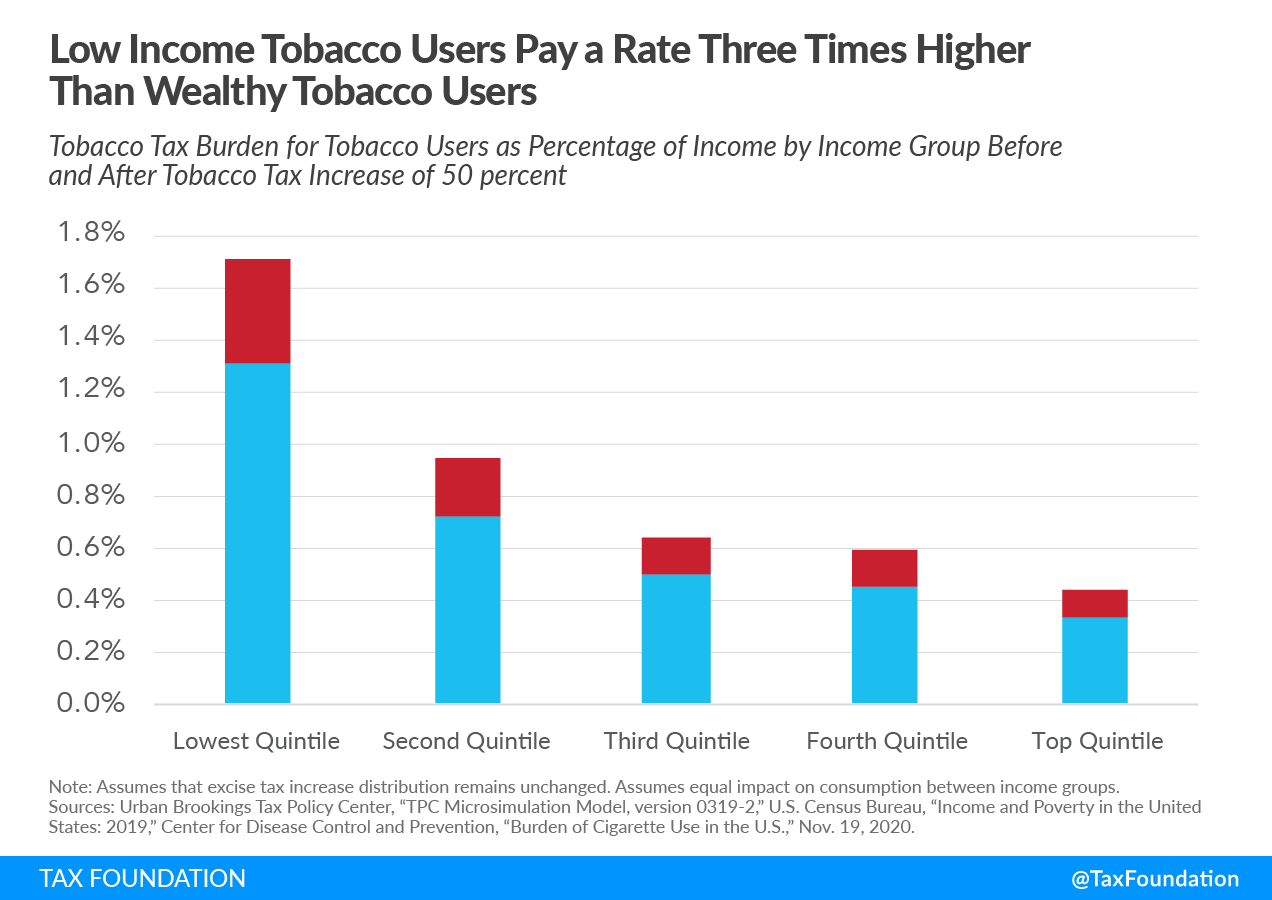

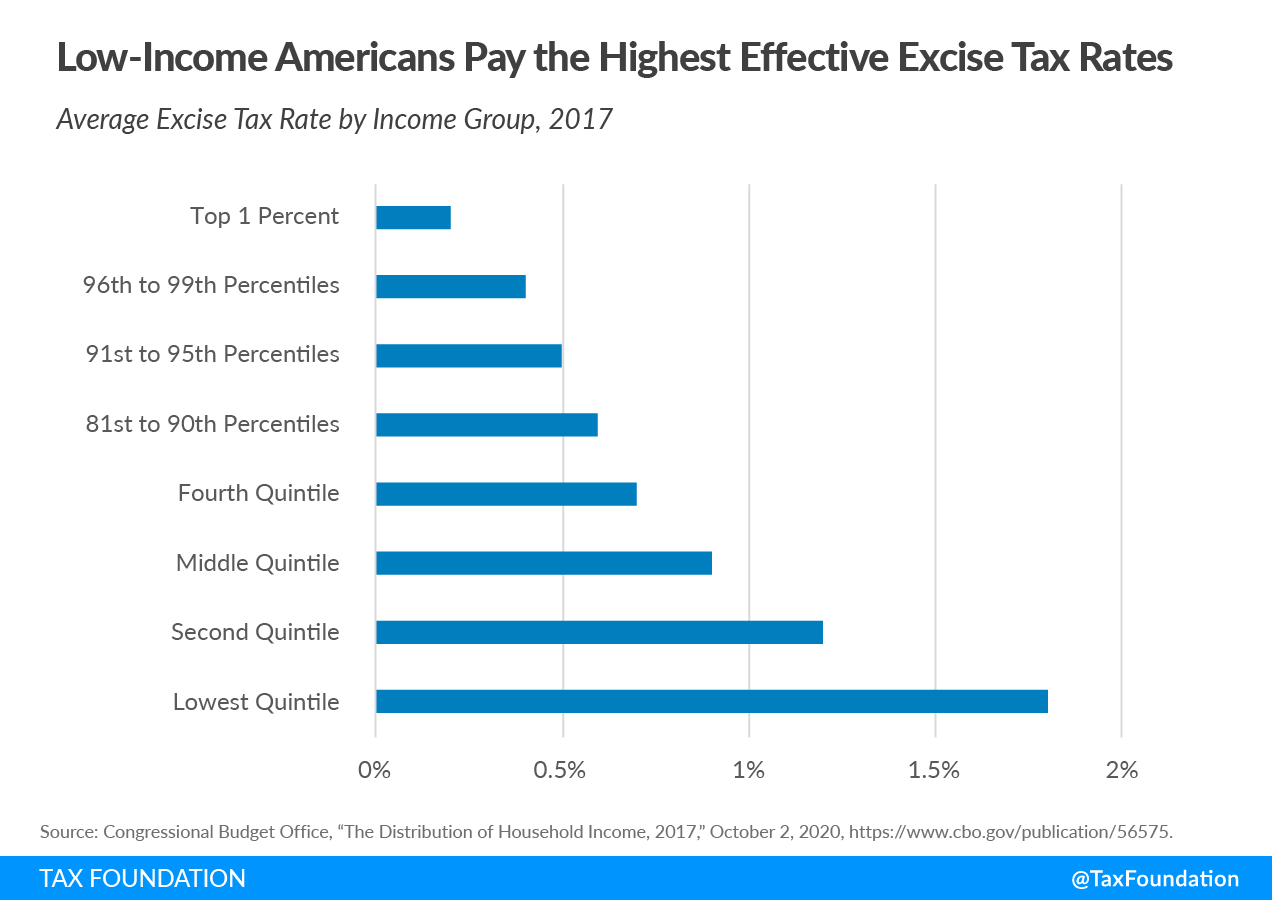

Excise Taxes Excise Tax Trends Tax Foundation

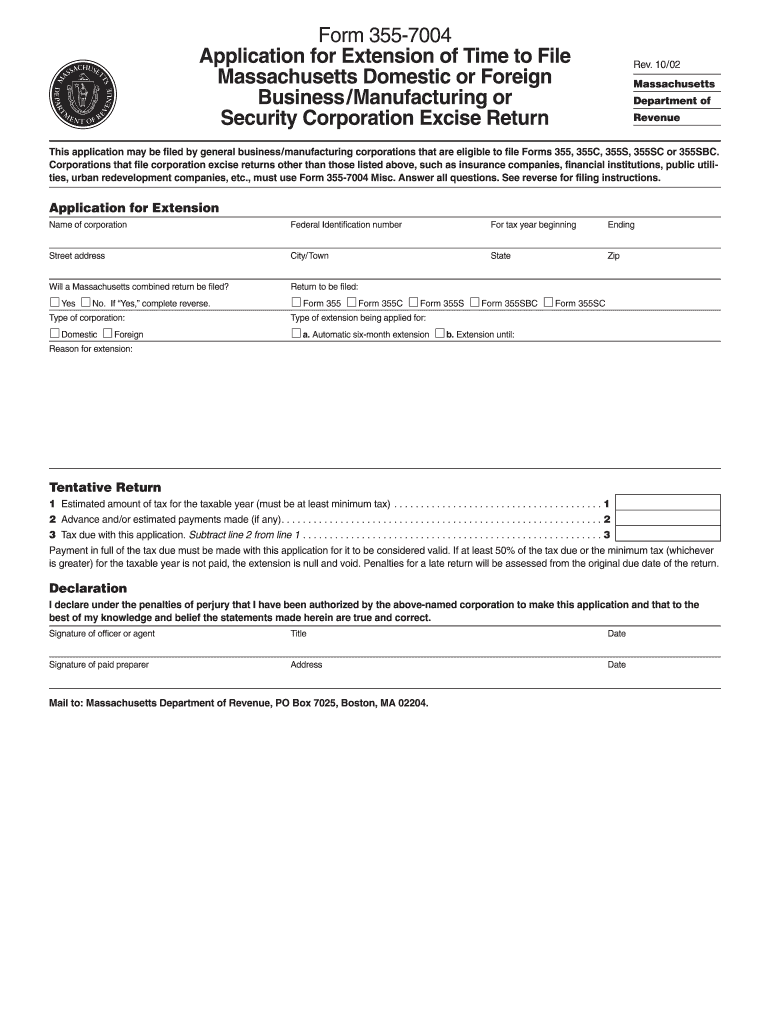

Corporate And Other Business Excise Description

When Excise Tax Feels Like Excess Tax Hagerty Media

Motor Vehicle Excise Tax Due Monday March 23 2020 Boxford Ma

Fuel Taxes In The United States Wikipedia

Pay Your Bills Online Winthropma

Motor Vehicle Excise Gardner Ma

Jeffery Jeffery Deputy Tax Collectors Massachusetts

Excise Tax What It Is How It S Calculated

Help Balance The Massachusetts Budget With This Salt Workaround Stephan P Mcmahon Company

Treasurer Collector Town Of Montague Ma

Massachusetts Marijuana Excise Tax Revenue Exceeds Alcohol For First Time

Do You Report Paid Excise Tax In Massachusetts

Town Of Fairhaven Collector S Office Reminder Excise Tax Bills Were Mailed On February 7 2019 And Are Due On March 8 2019 If You Have Not Received Your Bill Contact The Collector S

How To Pay Your Massachusetts Excise Tax Getjerry Com